Exempt waste

Under the Waste Reduction and Recycling Act 2011 (the Waste Act), some waste may be exempt from the waste levy. This includes:

- Disaster management and serious local event waste

- Approved exempt waste (by application only)

- Other specific exempt wastes (automatically exempt)

- Other declared wastes (exceptional circumstances)

It is important to note that despite a waste being exempt from the levy, a landfill operator may charge a gate fee to receive and manage the waste. This fee is separate to the waste levy and is set by the landfill operator.

Landfill operator obligations

Despite exemption from the levy, the landfill operator must still comply with other waste levy obligations, such as remitting levy on all waste received and disposed of at the site, installing weighbridges, and reporting to the Department of Environment, Science and Innovation. The relevant exempt waste number must be used in data recording and waste data returns. See information for landfill operators for details.

Disaster management and serious local event waste

Exempt waste includes wastes generated as a result of a disaster (e.g. flooding or bushfire) or a serious local event.

These exemptions are issued following the Queensland Government declaring a disaster situation or a local government notifying the department of serious local event.

For information about waste exemptions for disaster management and serious local event waste, including details of exemptions currently in effect and how local governments can notify the department of a serious local event, see Exemptions for disaster waste.

Approved exempt waste (by application)

Types of waste for which an application can be made

A person may apply to the department for approval of certain waste as exempt waste. The application may be about only one of the following types of waste:

- waste received as part of charity donations that cannot practicably be re-used, recycled or sold

- litter and illegally dumped waste which is collected as part of an organised community clean up activity

- earth contaminated with a hazardous contaminant from land listed on the environmental management register or contaminated land register

- waste necessary for the operation of the leviable waste disposal site, such as for building infrastructure, temporary or daily cover, progressive or final capping, batter construction, profiling and site rehabilitation.

In addition:

- The chief executive of the department that administers the Biosecurity Act 2014 may make an application about biosecurity waste.

- The chief executive of a local government area may make an application about serious local event waste (to extend the exemption period).

How to apply for waste levy exemption

A person may apply to the department for a waste levy exemption by completing and submitting the relevant application form. All the information requested in the form, and any relevant fees, must be provided.

Each application may only be for one of the exempt waste types. If you are seeking an exemption for multiple wastes, a separate application form must be submitted for each waste type.

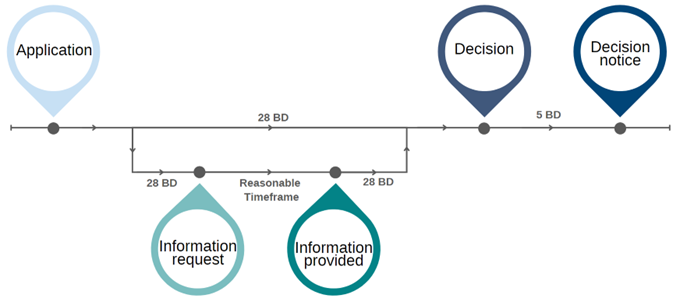

The application process and timeframes for assessing waste levy exemptions are outlined below.

- Application is submitted to the department

- The department will consider the application and within 28 days either:

- make a decision

or - ask for more information.

- make a decision

- If the department asks for more information, the applicant will be given a reasonable timeframe to provide this and the decision will be made within 28 days of receiving the information.

- Within 5 business days of making the decision, the department will:

- if approved: issue a notice including an exemption certificate and unique exempt waste number

or - if refused: issue an information notice about the decision.

- if approved: issue a notice including an exemption certificate and unique exempt waste number

It is important that all relevant supporting information is provided when making an application. An application is taken as withdrawn if an applicant does not respond to an information request within the timeframe stated. Further, applications where a decision is not made within 28 days of receiving the application or further information are considered to be refused.

What happens if my application is approved?

If the application is approved, the department will issue you a notice of approval that details:

- the waste that has been approved as exempt waste

- the period of the approval

- any conditions of the approval (e.g. specific landfills the waste can be disposed at and the amount of exempt waste that can be disposed of).

The notice will include an exemption certificate and unique exempt waste number.

What if my application is refused?

If the application is refused, the department will issue you an information notice that includes the reason for the decision and any relevant information on review rights.

When delivering the waste to a landfill for disposal, the waste levy will apply.

Disposing approved exempt waste to landfill

The approval holder must do the following in order to receive the levy exemption when disposing the exempt waste to the approved landfill:

- present the exemption certificate and unique exempt waste number (included on the exemption certificate) to the landfill operator

- comply with any conditions of the exemption certificate.

Other specific exempt wastes

Some waste types are automatically exempt from the levy through the Waste Act. An application for these types of wastes is not required. This includes:

- certain types of lawfully managed and transported asbestos waste

- dredge spoil if, for dredge spoil that is acid sulphate soil, the dredge spoil has been treated in accordance with best practice environmental management for the treatment and management of acid sulphate soils

- clean earth (until 1 July 2023)

- litter and illegally dumped waste collected by or for the State, a local government, or a forestry plantation licensee

- other waste prescribed by regulation

- other declared wastes (exceptional circumstances).

When disposing of these types of exempt wastes to landfill, you must provide evidence to the landfill operator that the waste meets the definition of exempt waste in section 26 of the Waste Act.

Asbestos waste

If certain criteria are met, asbestos waste may be exempt from the levy. Read the information sheet for guidance on how the waste levy applies to the disposal of asbestos waste.

Prescribed by regulation

The following waste is exempt from the waste levy under the Waste Reduction and Recycling Regulation 2011:

- waste water that meets the water quality for irrigation and general water use requirements stated in the guideline for water quality (PDF, 1.83MB), chapter 4.2; or

- waste water that meets the water quality for livestock drinking water requirements stated in the guideline for water quality (PDF, 1.83MB), chapter 4.3; or

- alum sludge or other residuals produced as a result of a drinking water treatment process (until the end of 30 June 2029); or

- waste generated in Norfolk Island and imported by the Norfolk Island Regional Council into Queensland (until the end of 30 June 2026); or

- fly ash produced by a power station (until the end of 30 June 2029); or

- residue waste from

- a glass beneficiation plant; or

- a material recovery facility.

When disposing of these types of exempt wastes to landfill, you must provide evidence to the landfill operator that the waste meets the criteria in in section 8 of the Waste Reduction and Recycling Regulation 2023.

Other declared wastes (exceptional circumstances)

The department may declare a waste to be exempt in exceptional circumstances. These exemptions are granted at the department’s discretion in accordance with section 35 of the Waste Act. Conditions may be imposed on any exemption declaration made.

Information about the declaration, including the exempt waste number, will be provided to the relevant local government and waste disposal site.

When disposing of waste declared exempt by the department due to exceptional circumstances, you must:

- provide the exempt waste number issued for the declaration to the landfill operator

- comply with any conditions of the declaration.

Declaration of exempt waste – waste donated to a Recognised Religious Organisation conducting a Charitable Recycling Activity

The department has declared that waste that has been donated to a recognised religious organisation but that cannot be practicably re-used, recycled or sold is declared to be exempt waste.

The Declaration of exempt waste details this exempt waste and conditions that apply.

The conditions of the declaration are:

- an organisation seeking to operate under this declaration must request and obtain approval from the department.

- in requesting approval the organisation must provide:

- information demonstrating the organisation:

- meets the definition of recognised religious organisation; and

- meets those parts of the definition of charitable recycling entity under sections 28(5)(a) and 28(5)(d) of the Act

- information as required in the approved form ‘Approval of waste as exempt waste—charitable recycling entity’, other than information relevant to section 28(5)(b) and 28(5)(c) of the Act.

- information demonstrating the organisation:

- If a request under this declaration is approved and a waste levy exemption issued, it must be presented each time the exempt waste is delivered to a waste disposal facility.

- The waste under this declaration is exempt from the date of declaration until 30 June 2027.

- A waste levy exemption issued under this declaration may be cancelled or amended for any of the reasons outlined in section 34 of the Act.

Declaration of exempt waste – power station ash waste

The department has declared power station ash waste (fly ash combined with other ash waste) as exempt from the waste levy from the date of publication until to 31 December 2025 inclusive.

The Declaration of exempt waste – power station ash waste details this exempt waste and conditions that apply.

The conditions of the declaration are:

- Exempt waste means power station ash (fly ash combined with other ash waste) produced by a power station in the State of Queensland.

- Waste is exempt waste for the period from the date of publication up to and including 31 December 2025 only.

Declaration of exempt waste – Northern Iron and Brass Foundry

The department has declared used foundry sand generated by the Northern Iron and Brass Foundry as exempt waste from the waste levy from the date of publication until 31 December 2028.

The Declaration of exempt waste – Northern Iron and Brass Foundry details this exempt waste and conditions that apply.

The conditions of the declarations are:

- foundry sand is exempt waste under this declaration from the date of this declaration to 31 December 2028 inclusive.

- this declaration does not apply to other waste mixed with foundry sand.

- this declaration applies only to foundry sand generated by Northern Iron and Brass Foundry.

- this declaration only relates to exemption from the waste levy. It does not affect requirements or conditions of any environmental authority or any other approval, permit or obligation under the Environmental Protection Act 1994, the Waste Reduction and Recycling Act 2011, or any other legislation.

Declaration of exempt waste – Yarrabah Aboriginal Shire Council (sewage treatment plant sludge removal works)

The department has declared waste removed from the Yarrabah Aboriginal Shire Council sewage treatment plant as exempt from the waste levy from 11 December 2024 to 31 December 2025 inclusive.

The conditions of the declaration are:

- waste declared to be exempt under this declaration is limited to sewage sludge waste (biosolids) removed from the Yarrabah Aboriginal Shire Council sewage treatment plant, located at King Beach Road, Yarrabah, QLD 4871, as part of sewage treatment plant sludge removal works

- if waste declared to be exempt under this declaration is to be used for on-site operational purposes, the waste must meet all relevant requirements or limits for the waste types approved under 220043OSOP for the waste disposal site: Remondis – Springmount Waste Management Facility (C108410)

- if waste declared to be exempt under this declaration is to be disposed, the waste must meet all relevant conditions and limits within environmental authority BRID00026 for the waste disposal site: Remondis – Springmount Waste Management Facility (C108410)

- the amount of waste exempted under this declaration is limited to a total of 900 tonnes.

Declaration of exempt waste – Cairns Regional Council, Queensland

The department has declared waste removed from the Cairns Regional Council, Queensland as exempt from the waste levy from 1 July 2025 to 30 June 2026 inclusive.

The conditions of the declaration are:

- Waste declared to be exempt under this declaration is limited to municipal solid waste that is collected by Cairns Regional Council in its respective local government area and removed from the Veolia Recycling and Recovery (Regional Queensland) Pty Ltd facility, located at 35-51 Lyons Street, Portsmith, QLD 4870.

- Municipal solid waste is exempt waste only if it would have been destined for processing at the Advanced Resource Recovery Facility, Portsmith, during the period of the exemption.

- Waste is exempt waste only if it is transported by Cairns Regional Council or Veolia Recycling and Recovery (Regional Queensland) Pty Ltd, or by contractors on behalf of both entities.

- Cairns Regional Council must provide the administering authority a report within one month after the end date of the exemption, which contains details of each transaction of waste delivered to the waste disposal site authorised under this declaration.

Declaration of exempt waste – Mareeba Shire Council, Queensland

The department has declared waste removed from the Mareeba Shire Council, Queensland as exempt from the waste levy from 1 July 2025 to 30 June 2026 inclusive.

The conditions of the declaration are:

- Waste declared to be exempt under this declaration is limited to municipal solid waste that is collected by Mareeba Shire Council in its respective local government area.

- Municipal solid waste is exempt waste only if it would have been destined for processing at the Advanced Resource Recovery Facility, Portsmith, during the period of the exemption.

- Waste is exempt waste only if it is transported by Mareeba Shire Council or its contractors.

- Mareeba Shire Council must provide the administering authority a report within one month after the end date of the exemption, which contains details of each transaction of waste delivered to the waste disposal site authorised under this declaration.

Declaration of exempt waste – Douglas Shire Council, Queensland

The department has declared waste removed from the Douglas Shire Council, Queensland as exempt from the waste levy from 1 July 2025 to 30 June 2026 inclusive.

The conditions of the declaration are:

- Waste declared to be exempt under this declaration is limited to municipal solid waste that is collected by Douglas Shire Council in its respective local government area and removed from the Veolia Recycling and Recovery (Regional Queensland) Pty Ltd facility, located at 35-51 Lyons Street, Portsmith, QLD 4870.

- Municipal solid waste is exempt waste only if it would have been destined for processing at the Advanced Resource Recovery Facility, Portsmith, during the period of the exemption.

- Waste is exempt waste only if it is transported by Douglas Shire Council or Veolia Recycling and Recovery (Regional Queensland) Pty Ltd, or by contractors on behalf of both entities.

- Douglas Shire Council must provide the administering authority a report within one month after the end date of the exemption, which contains details of each transaction of waste delivered to the waste disposal site authorised under this declaration.